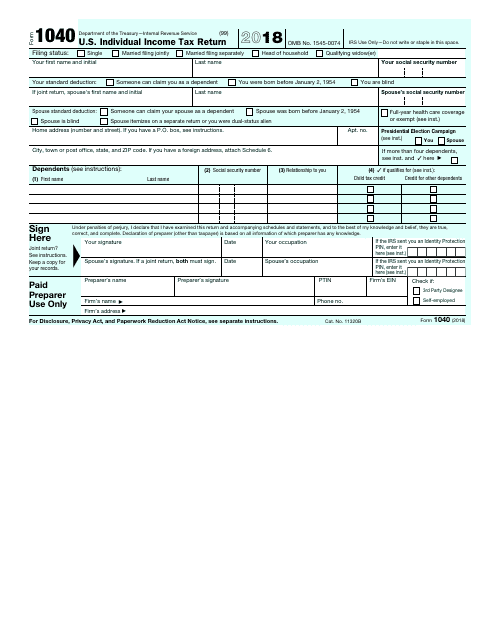

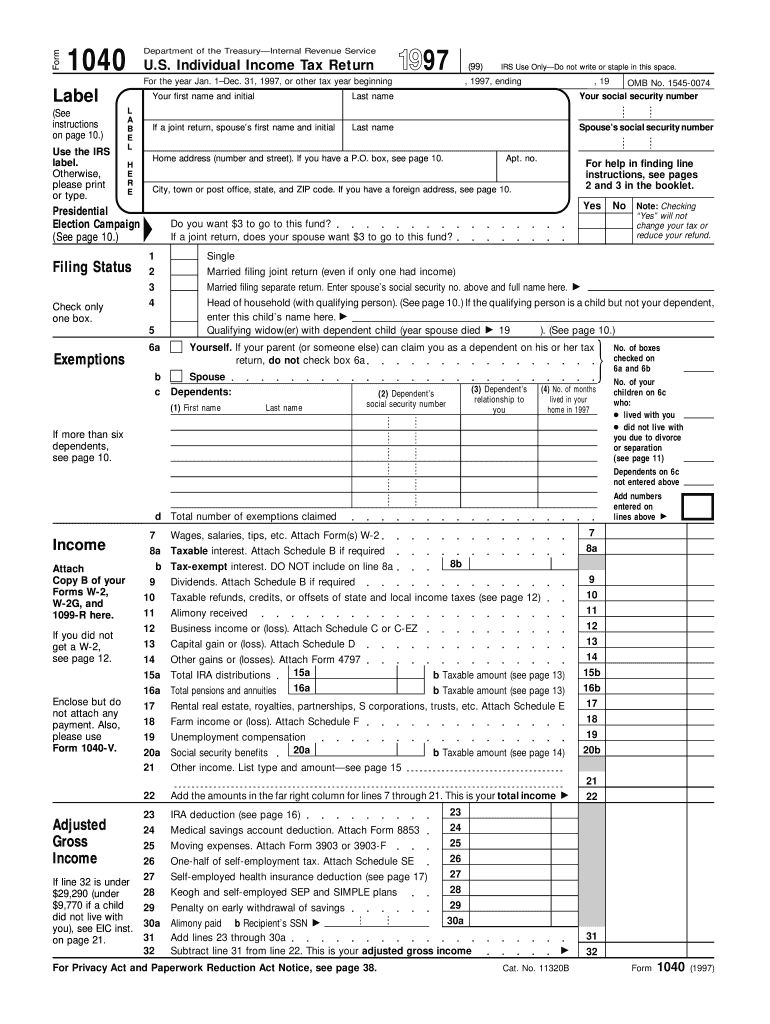

The better option is to submit the petitioner’s Tax Return Transcript. USCIS prefers receiving Tax Return Transcripts Also, simply providing USCIS with a Form 1040 is not proof that you actually filed the same Form 1040 with the IRS. For immigration purposes, it is insufficient to submit Form 1040 without the accompanying schedules. Individual tax returns include Form 1040 and all accompanying schedules and forms.

The problem is, tax returns can sometimes be 100 pages in length. To do so, the parties must submit the petitioner’s federal individual income tax return for the most recent year. citizen petitions for a foreign relative beneficiary to adjust status in the U.S., the parties have to prove that the petitioner’s income is sufficient to support the beneficiary. But instead of a regular tax return (Form 1040), you can submit a much shorter Tax Return Transcript. Do I have to submit the entire tax return?Īnswer: Yes. I know I have to submit my most recent year’s tax return, but my tax return is over 100 pages long.

I’m applying for my wife to adjust status and obtain a green card.

0 kommentar(er)

0 kommentar(er)